CU*BASE has some of the best analytical tools to handle best practice requirements and tasks associated with regulatory requisites. This describes some of my favorite software features which save our credit unions countless hours and money.

We pride ourselves in helping our owners meet new regulatory and third-party audit requirements utilizing already existing data and member activity in record time. This is done in a cooperative environment including multiple compliance professionals throughout the network.

I selected the following sample dashboards and reports to draw attention to the power of the data analytics the system provides and areas where your executive team can get immediate answers to more complex questions.

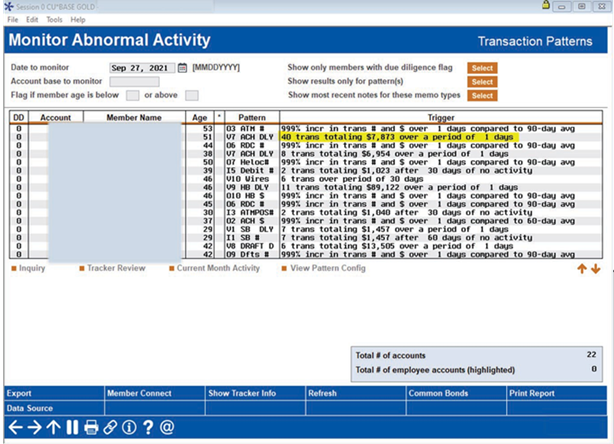

Abnormal Activity: Transaction Pattern Dashboard

The Abnormal Activity Monitoring Dashboard is one of the largest investments CU*Answers has made to help credit unions monitor and mitigate losses due to fraud and uncover high risk activity. The patterns used to make this functionality align with your unique membership, geography, and product structure are designed by you using your data verses sending it to a third party.

What you can analyze with this report:

In response to the increase regulatory pressure to have systems in place to monitor abnormal activity across all channels CU*Answers had built robust native fraud management functionality. This is part of the core platform, included at no additional cost to your credit union.

How to access this report:

Access this report by selecting Tool #537: Monitor Abnormal Activity.

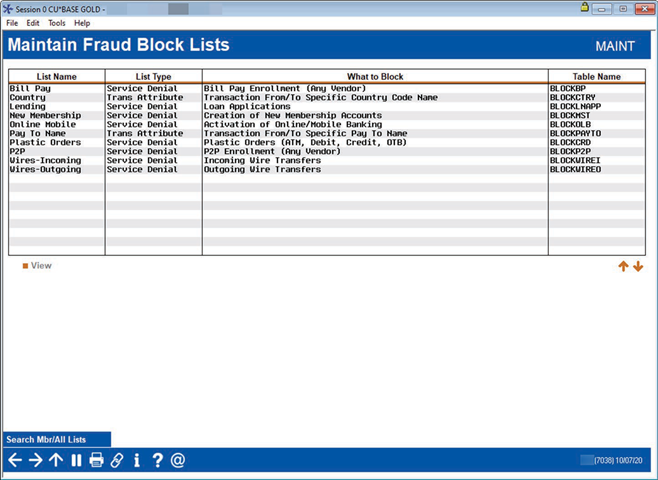

Blocked Persons Dashboard

This dashboard allows your credit union to easily deny members from using a type of transaction or service they have abused or been involved in fraudulent activity in the past. Your credit union can block members who share online banking credentials with scam artists or lose money through Person to Person (P2P) transactions by giving up their credentials. Also, you can stop employees who do not take the time to read comments which describe restrictions from accidentally reissuing a debit or credit card.

What you can analyze with this report:

The Blocked Persons Dashboard creates a centralized place to see and stop activity based on patterns the credit union sees as risky or potentially fraudulent. Additionally, this database allows you to record names and, if known, Social Security Numbers (SSNs) of individuals for whom membership should be denied using an infrastructure independent from membership and other key data tables.

How to access this report:

Access this report by selecting Tool #892: View Fraud Alert/Blocked Persons List.

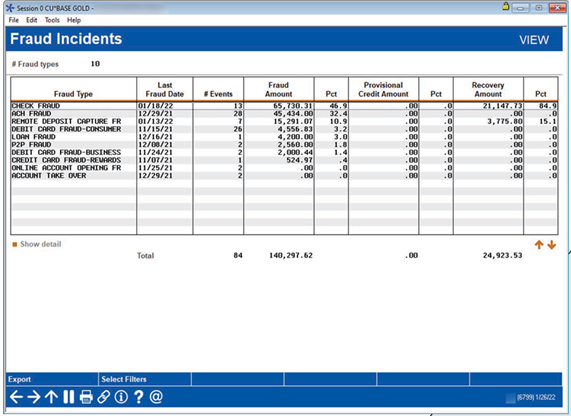

Fraud Incident Dashboard

At one push of a button your Chief Financial Officer (CFO) can instantly see how much and what types of fraud is affecting the credit union. This dashboard gives them vital information in determining additional loss mitigation controls to put in place to limit future losses.

What you can analyze with this report:

This tool is a centralized place for our network to log fraud incidents for the first step in a process to shift focus from compliance monitoring to fraud prevention. It allows you to research how the losses occurred and drill deeper to document the particulars of each instance.

How to access this report:

Access this report by selecting Tool #1710: Fraud Incident Dashboard.

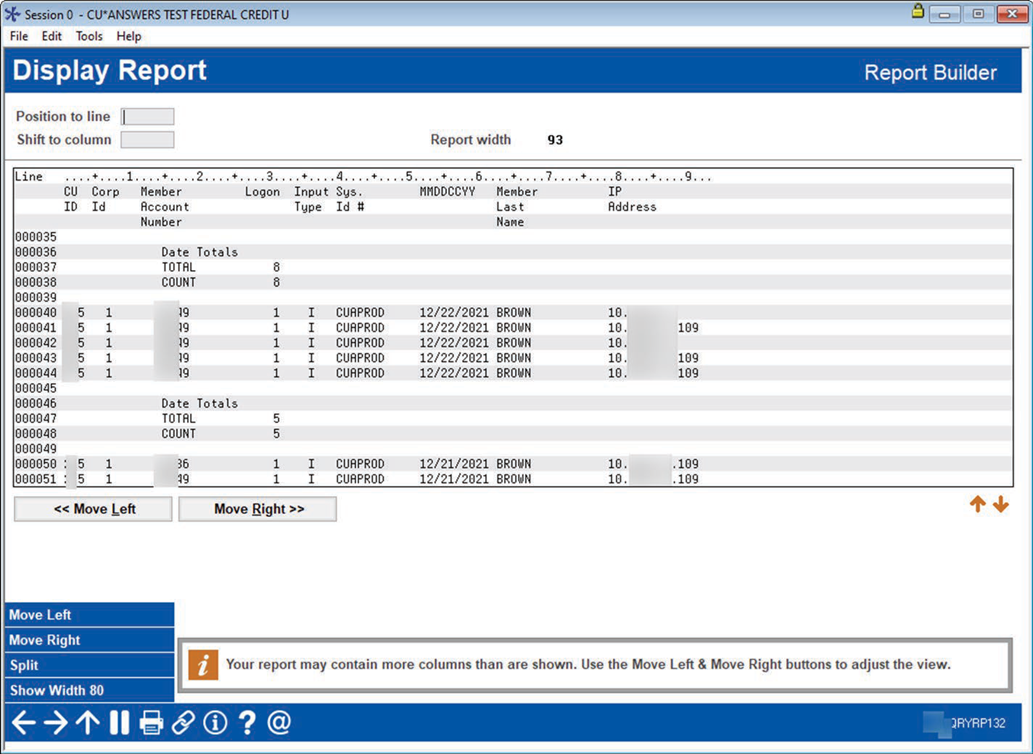

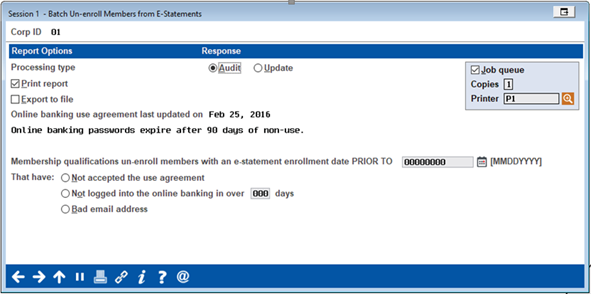

Online Banking and Audio Response Dashboard

Very recently FinCEN has requested that IP addresses be included in a suspicious activity reports. When a members account is compromised, and the criminal gains access to their online banking account, this dashboard documents the IP address where the log on initiated.

What you can analyze with this report:

The Online Banking and Audio Response Detail Statistics tool uses IBM Query to produce a display showing all member activity using online banking. Use this to crucial information relating to where the log on occurred.

How to access this report:

Access this report by selecting Tool #565: Online Banking Detail Stats (AUDICC).

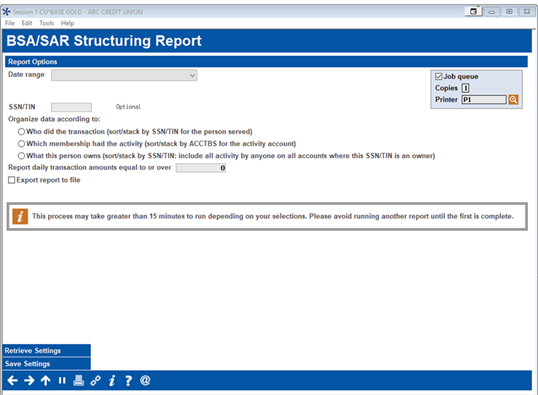

BSA/SAR Structuring Report

There is growing concern in the regulatory environment regarding the detection of cash related activity performed by an individual on their primary account and then subsequent activity on accounts they on which are only joint. This tool is designed to uncover those events and many more by virtue of its robust analytical capabilities.

What you can analyze with this report:

This report provides a more comprehensive and detailed analysis of smaller denomination cash transactions that would normally fall below the standard range for BSA monitoring, to help your auditors look for signs of structuring or other suspicious activity. Multiple filtering options allow you to add multiple attempts to hide transactions that might not be caught by standard reporting and analysis. The file used by the report is organized not only by primary member but by joint owners allowing you even deeper analysis.

How to access this report:

Access this report by selecting Tool #1990: Print BSA/SAR Structuring Report.

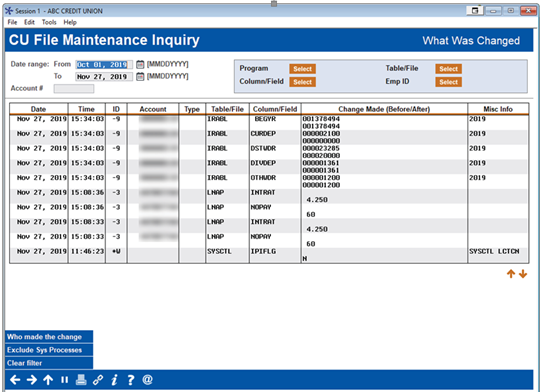

File Maintenance Dashboard (CUFMAINT)

Reviewing file maintenance can be one of the most tedious tasks in an audit department’s day. It can take hours to sift through all the logs to determine what is important for further reviews. This dashboard gives staff the capability to instantly sort through all the noise and go right to those critical data elements deserving a deeper dive.

What you can analyze with this report:

This dashboard is use monitor file maintenance activity made by various programs throughout the CU*BASE system. Data from the CUFMAINT file is displayed with the most current activity at the top.

How to access this report:

Access this report by selecting Tool #159: Audit CU File Maintenance (CUFMAINT).

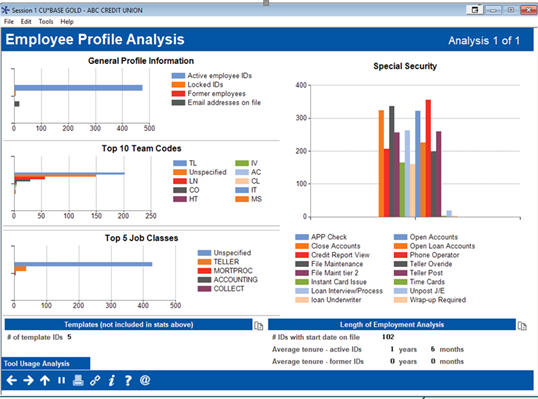

Employee Security Profile Analysis

Risk managers will give this dashboard serious consideration. This graphical display paints and easily understood overall picture of the system functionality granted to all team members across the organization rated by those tools and processes used the most. In essence, displays any perceived riskier processes and the amount of team member having access to them.

What you can analyze with this report:

This screen shows summary statistics and graphs of key employee security settings, for all of your credit union’s active and archived employee IDs.

How to access this report:

Access this report by selecting Tool #1190: Employee Security Profile Analysis. It can also be accessed via the Profile Analysis button on the main Employee Security dashboard.

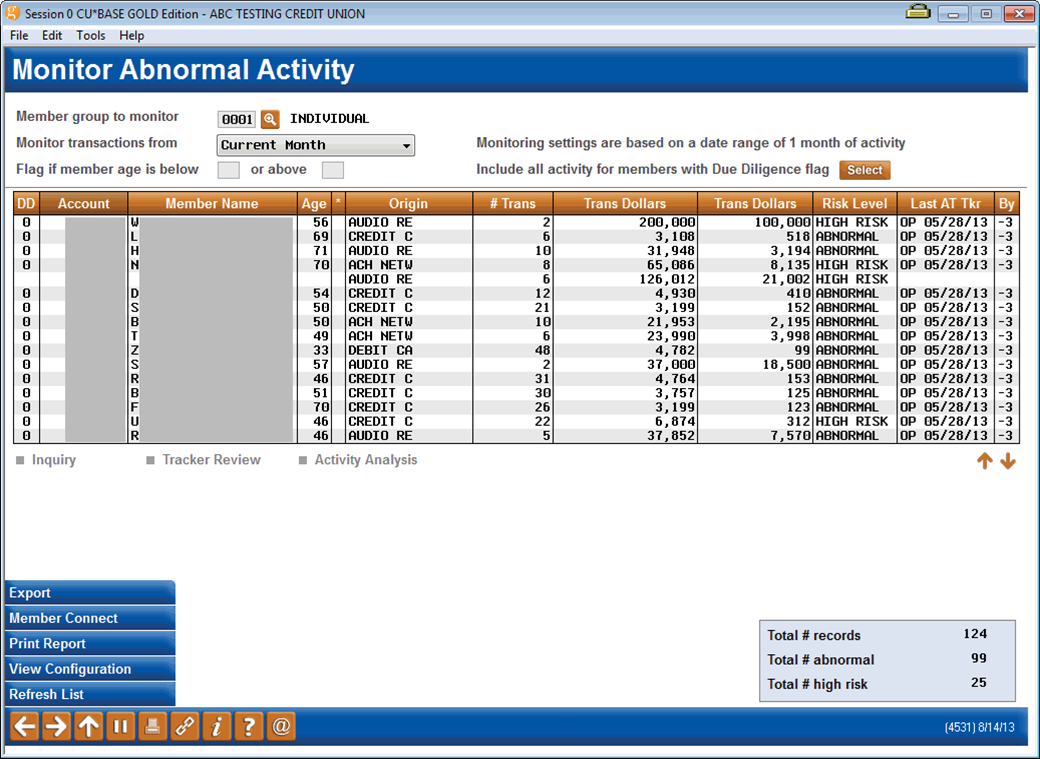

Abnormal Activity: Member Group Dashboard

This software feature was developed for a number of reasons including the FFIEC’s Guidance letter on managing high-risk account activity, elder abuse, and low-level BSA and ACH activity. It goes hand in hand with the coding of member due diligence levels for the ongoing monitoring and detection of high-risk accounts.

What you can analyze with this report:

Use this time-saving tool to quickly identify abnormal or high-risk transactions according to the parameters set by your credit union. Use this screen to monitor abnormal activity for a number of member groups including regular members and commercial fiduciary, and to detect smurfing.

How to access this report:

Access this report by selecting Tool #537: Monitor Abnormal Transaction Activity.

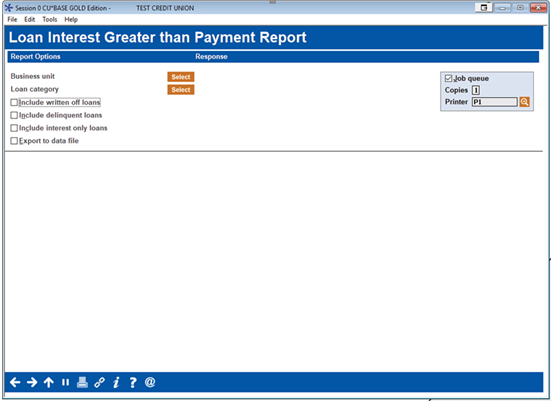

Loan with Interest Due Above Payment Amount

This report is a pre-emptive tool which will keep you one step ahead of your examiner. The same math that we are using to uncover potentially negatively amortizing loans is used by examiners when you supply them with your AIRES file. Make sure your employees create a collection Tracker describing the situation for every one of these loans.

What you can analyze with this report:

This report lists accounts with interest due that is greater than the payment amount and not delinquent. It identifies loans with potentially inherent collections problems which are not always apparent to credit union management.

How to access this report:

Access this report by selecting Tool #480: Loans w/ Interest Due Above Payment Amt.

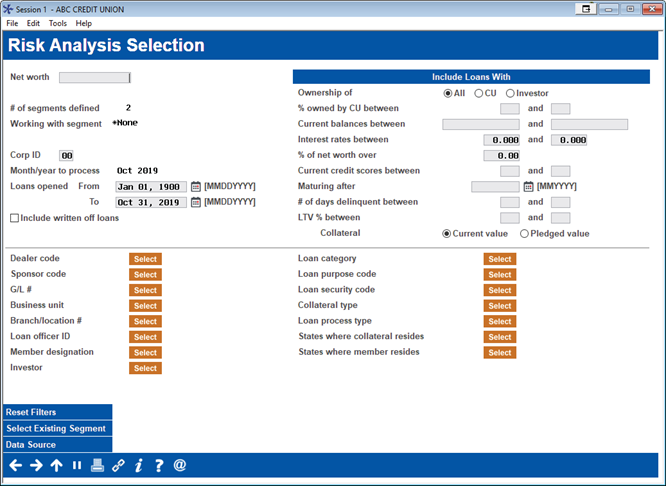

Loan Portfolio Concentration Risk Summary

Since 2010 credit union have been required to evaluate, analyze, and report on concentrations of loans and specific segments. This tool was developed to help you manage and trend all your concentration risk segments. It is the premiere software tool provided to credit unions from a compliance perspective in the last few years.

What you can analyze with this report:

This is the first of four analysis screens which help you monitor the policy limits you have in place, analyze the credit quality of the segment itself, and to review the membership, product, and collateral makeup of the loans found in the segment. Vital to this feature is your ability to save your analytics month over month for trending purposes.

How to access this report:

Access this report by selecting Tool #592: Portfolio Analysis – Concentration Risk. Define a segment and select Summary (F12).

Work Dormancy Summary Dashboard

How many active members do you really have? Use this dashboard when determining not only members no longer using you, but what your actual active member count is. How well is your team mitigating risk through the evaluation of recent activity on inactive accounts and how is your strategy for reengaging inactive members working out? This dashboard will answer that and many other questions.

What you can analyze with this report:

This report lists accounts with interest due that is greater than the payment amount and not delinquent. This handy tool calculates and displays a summary of all funds in dormant accounts, suspended dormant accounts, and accounts ready to be escheated to the state, according to the length of time the member has been on the dormancy list.

How to access this report:

Access this report by selecting Tool #985: Work Dormant Members, then Summary (F15).

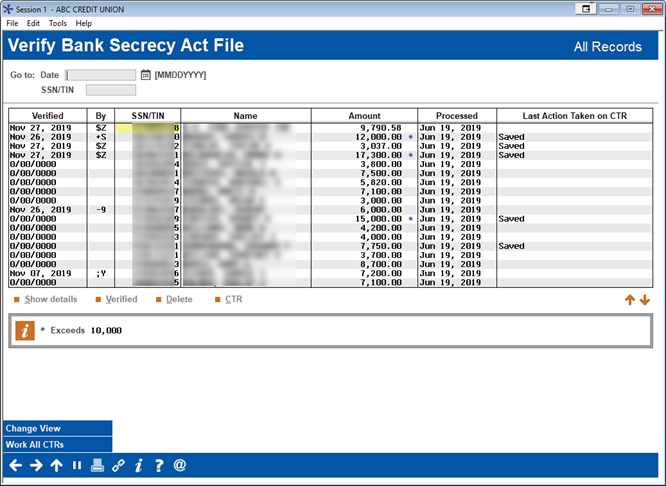

Bank Secrecy Act (BSA) Dashboard

This is the techie way to manage your Bank Secrecy audit functions. The screen populates with the same data found on your daily BSA reports but gives you an online working queue and a way for you to electronically keep track of your verification process. You can even use this electronic log to transmit CTRs to FinCEN—no retyping required!

What you can analyze with this report:

Use the BSA Activity Inquiry to verify transactions against the various reports your credit union is required to submit. This inquiry allows you to mark items as “verified” as you check them against the Currency Transaction Report and/or Suspicious Activity Reports your credit union is required to file.

How to access this report:

Access this report by selecting Tool #984: Work Daily BSA/CTR Activity.

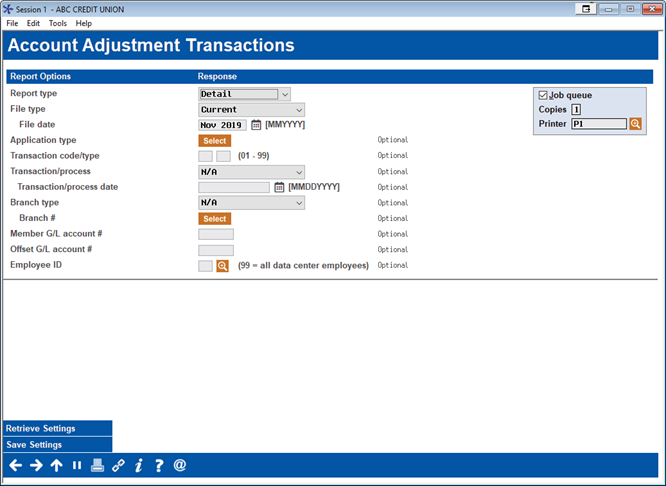

Member Account Adjustment Report

Our Audit Link staff uses this report to drill down to research how many teller transactions are being reversed when cash is involved. It is a vital report for monitoring the number of teller mistakes and for verifying that reversed cash transactions are reapplied appropriately.

What you can analyze with this report:

This report is used by head tellers, back office staff, and auditors. From a head teller perspective this report will show mistakes made by the staff when applying cash. From a back office perspective this report can be a vital tool in researching why the cash account is off. From an auditing perspective this report shows cash transactions that have been reversed. Auditors will use this report to verify that the cash was reapplied appropriately.

How to access this report:

Access this report by selecting Tool #493: Member Account Adjustments Report.

Provided by Jim Vilker, vice president of professional services AuditLink, CU*Answers